Introduction: What AB 943 Means for Future California Agents

If you’re planning to get a California insurance license in 2026, you will not be following the same rules earlier generations of agents did.

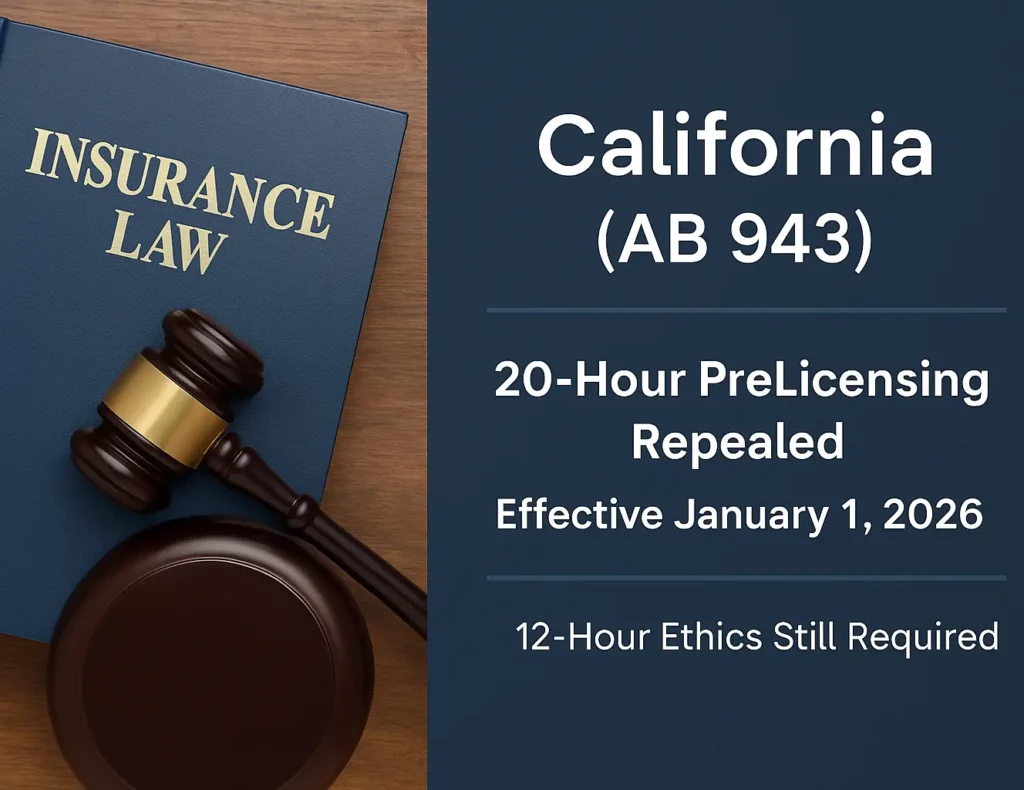

Under AB 943, effective January 1, 2026, California will remove the 20-hour line-specific prelicensing education requirement for most producer license applicants, while keeping the 12-Hour Ethics and California Insurance Code course mandatory for license issuance.

For you as a future producer, this shifts the focus from logging hours to one thing: being fully prepared to pass the state exam and complete the 12-Hour Ethics requirement quickly and correctly.

What AB 943 Changes for Prelicensing Students

What Is Being Repealed?

AB 943 eliminates the requirement that applicants for most producer licenses complete 20 hours of prelicensing study per line of authority in California Insurance Code section 1749.

The 20-hour prelicensing repeal applies to applicants for:

- Life

- Accident and Health or Sickness

- Property

- Casualty

- Commercial Lines

- Personal Lines

- Limited Lines Automobile

Beginning January 1, 2026, these applicants are no longer bound by the statutory 20-hour classroom/self-study mandate for general insurance content.

What Still Remains Required: 12-Hour Ethics

The law does not remove the requirement to complete 12 hours of study in Ethics and California Insurance Code. That course is still required before the Department of Insurance (CDI) will issue your license.

Key points:

- You must complete a CDI-compliant 12-Hour Ethics & California Insurance Code course.

- Time tracking and provider approval still apply to this Ethics requirement.

- The 12-Hour Ethics course must include 1 hour of insurance fraud education.

License Types Not Affected by the 20-Hour Repeal

The 20-hour requirement remains for:

- Bail agents

- Public insurance adjusters

If you are going into those lines, your prelicensing structure stays largely the same.

Why This Is Good News for Students

The AB 943 prelicensing change offers several advantages:

- Less time-based restriction. You are not forced into a fixed 20-hour format for each producer license line.

- Faster path to the exam. Highly motivated students can move into exam scheduling sooner.

- Lower potential cost. Removing mandated hour requirements can reduce required course spend for many candidates.

- More focus on true exam readiness. CDI is refocusing on License Examination Objectives rather than enforcing a specific number of hours for general insurance topics.

In practice, you trade rigid hours for a results-based model: prove what you know on the exam and complete Ethics.

How Licensing Will Work in California Starting January 1, 2026

From January 1, 2026, the process to meet the California insurance license requirements will center on four pillars: exam objectives, exam results, Ethics, and background checks.

At a high level, the new flow looks like this:

- Select Your License Line(s) – Decide whether you need Life, Accident & Health or Sickness, Life & Health combo, Property & Casualty, Personal Lines, Commercial Lines, or Limited Lines Auto.

- Study to the License Examination Objectives – CDI is converting the former “Prelicensing Educational Objectives” into License Examination Objectives and publishing them as a study guide. Providers build exam prep materials around that outline, but CDI will no longer pre-approve most non-Ethics prelicensing courses after January 1, 2026.

- Take the State Licensing Exam – The exam content and structure are not changing because of AB 943; the test is still tied to the same objectives.

- Complete the 12-Hour Ethics & California Insurance Code Course – You may schedule and sit for the exam without finishing Ethics, but you cannot receive a license until an approved provider reports your 12-Hour Ethics completion.

- Satisfy Fingerprinting and Background Requirements – CDI still requires fingerprinting (e.g., Live Scan) and a background review for all new resident applicants.

- Apply for Your License and Wait for CDI Approval – Once exam, Ethics, fingerprints, and fees are complete, CDI processes your application and issues your license if all requirements are satisfied.

This is the new reality of California prelicensing 2026: seat hours are no longer the main hurdle; exam results and Ethics completion are.

Step-by-Step: How to Get Your California Insurance License in 2026

This roadmap is written specifically for the AB 943 prelicensing change and assumes you are starting your journey in 2026 or later.

Step 1 – Define Your Career Track

Clarify what you plan to sell:

- Life-only or Life & Health if you want to focus on life policies, annuities, and health insurance.

- Property & Casualty if you want to sell auto, home, and commercial P&C.

- Personal Lines or Limited Lines Auto if you plan to focus more narrowly on consumer P&C products.

Your choice determines which SuccessPrelicensing.com exam prep path you follow.

Step 2 – Build an Exam-First Study Plan

With the 20-hour prelicensing repeal, your focus should be mastering the material that shows up on the exam, not watching a clock.

A solid exam-first plan includes:

- A course or curriculum organized directly around California License Examination Objectives.

- Topic-by-topic lessons, including California-specific rules and regulations.

- Section quizzes to confirm comprehension as you go.

- Integrated review tools such as chapter summaries, quick-reference sheets, and flashcards.

On SuccessPrelicensing.com, this translates into line-specific prelicensing courses that are optimized for learning speed and retention, not time spent.

Step 3 – Enroll in the 12-Hour Ethics & California Insurance Code Course

The Ethics requirement does not go away in 2026. You still must complete 12 hours of Ethics and California Insurance Code, including one hour of insurance fraud training, through an approved course.

Best practice for most students:

- Plan the Ethics course early—either parallel to your main exam prep or immediately after you feel confident with the core content.

- Confirm that your Ethics provider is CDI-approved and will handle time tracking and roster reporting correctly.

SuccessPrelicensing.com can provide a California-specific 12-Hour Ethics & Insurance Code course designed to fit seamlessly into your overall license plan.

Step 4 – Use Practice Exams to Pressure-Test Your Knowledge

Before you put real money and time into the official exam:

- Take multiple full-length California practice exams in test mode.

- Aim for consistent scores of 80-85% or higher.

- Identify patterns in your missed questions (e.g., policy provisions, state-specific time frames, or licensing rules).

- Loop back to targeted review modules and flashcards to close those gaps.

In the California prelicensing 2026 framework, your pass rate depends heavily on how seriously you treat practice exams.

Step 5 – Schedule the California Insurance Exam

Once your practice scores are stable:

- Create your testing account with the CDI-approved exam vendor.

- Pick a date within 1-2 weeks of your latest practice exam run.

- Confirm ID and check-in requirements so there are no surprises on test day.

Remember: Ethics completion is not required to schedule the exam, but is required to issue the license, so time your Ethics course accordingly.

Step 6 – Complete Fingerprinting

Plan your fingerprinting (e.g., Live Scan) to line up with your testing and application timeline:

- Verify approved fingerprinting locations.

- Bring required identification and forms.

- Keep all receipts and confirmation documents.

Delays in fingerprinting can hold up your license even if you have passed the exam and finished Ethics.

Step 7 – Submit Your Application and Monitor Status

Finally:

- File your license application and pay the required fees.

- Confirm that your Ethics provider has reported your completion to CDI.

- Monitor your application status and respond quickly if CDI requests clarification or additional information.

Once CDI clears exam results, Ethics completion, fingerprints, and your background, your license can be issued. That is the complete path for how to get an insurance license in California 2026 under AB 943.

Why the 20-Hour Repeal Makes Exam Prep More Important Than Ever

AB 943 removes seat-time rules; it does not lower the knowledge standard. The exam still measures whether you understand products, compliance, and ethical duties at a professional level.

Several realities follow:

- No “easy pass” effect. The exam questions, passing scores, and objectives remain in place. The test is not easier because hours went away.

- More variation in course quality. Since CDI will only be formally approving the Ethics course (plus bail and adjuster prelicensing), the quality of non-Ethics prelicensing materials depends on the provider, not on a state approval stamp.

- Your study choices now matter more. In the old model, mediocre courses could still claim “state approved” status for 20-hour content. In the new world, what matters is whether the curriculum actually gets you past the exam and ready to serve clients.

In short: the 20-hour prelicensing repeal shifts responsibility to you and your chosen provider. Well-structured, exam-focused training from SuccessPrelicensing.com becomes a competitive advantage, not an optional extra.

How SuccessPrelicensing.com Supports the New California Prelicensing Landscape

To help you take full advantage of California prelicensing 2026, SuccessPrelicensing.com is positioned as a single hub for both exam prep and the remaining 12-Hour Ethics requirement.

Here’s how you can plug in:

Life & Health Prelicensing

Choose an online Life, Accident & Health, or combined Life & Health program that:

- Follows the California License Examination Objectives

- Explains complex concepts in plain language

- Builds in checkpoints so you know when you’re truly exam-ready

Use our California Life & Health Prelicensing program to move from beginner to exam-ready with a clear, guided path.

Property & Casualty Prelicensing

If your focus is auto, home, or commercial insurance, a Property & Casualty prelicensing course will align directly with the new California exam structure.

Foundation Packages

For many students, the best approach is an integrated package:

- Core prelicensing instruction

- Full-length practice exams

- Flashcards and quick-review tools

- Study schedules designed for working adults

Select a California Foundation Package to keep everything you need for exam readiness in one place.

Flashcards & Quick Review Tools

Use digital flashcards to drill:

- Key definitions

- Policy features

- California-specific timeframes and rules

Practice Exams

Realistic practice exams are your best predictor of success:

12-Hour Ethics & California Insurance Code Course

Finally, you will need a compliant, CDI-approved solution for the 12-hour Ethics requirement.

Complete your mandatory 12-Hour Ethics & California Insurance Code Course through Success Prelicensing and lock in the last step before license issuance.

California Prelicensing 2026 FAQ

1. If the 20-hour requirement is gone, do I still have to take any courses?

Yes. AB 943 only removes the 20-hour line-specific prelicensing requirement, not the Ethics requirement. To receive your license, you still must:

- Complete a 12-Hour Ethics & California Insurance Code course from an approved provider, and

- Pass the state exam

You are not legally forced into a 20-hour general insurance course, but skipping structured exam prep is risky.

2. Do I have to finish the 12-Hour Ethics course before I can schedule my exam?

No. CDI has stated that completing Ethics is not required to be authorized to schedule or take the exam. However, you cannot be issued a license until the 12-Hour Ethics course is completed and reported.

Most students either:

- Take Ethics during their main study period, or

- Take it right after achieving strong practice exam scores, so there is no licensing delay.

3. I started prelicensing in 2025. Do my old 20- or 32-hour course completions still count in 2026?

Yes, with limits. CDI allows:

- Credit for 20-, 32-, and 52-hour prelicensing courses completed on or before December 31, 2025.

- Providers until January 11, 2026, to submit rosters for those courses.

- Deactivation of those prelicensing courses on January 12, 2026.

Also, prelicensing certificates remain valid for three years, as stated in the Insurance Code, and AB 943 did not change that.

4. Does AB 943 change continuing education (CE) after I am licensed?

No. AB 943 strictly targets prelicensing education, not post-licensing continuing education. CE requirements (such as 24 hours per renewal for many resident agents) remain governed by separate statutes and rules.

You will still need to meet CE requirements on an ongoing basis once licensed.

5. Are bail agents and public adjusters part of the 20-hour prelicensing repeal?

No. AB 943 explicitly states that bail agents and public insurance adjusters must continue to complete a 20-hour prelicensing course before their licenses can be issued.

If you plan to pursue those lines, your prelicensing education is not changing under AB 943.

6. Will the California insurance licensing exams get easier because of AB 943?

No. CDI has clarified that the exam itself is not changing in response to AB 943. The same core License Examination Objectives will drive the test content.

What changes is how you prepare: you are no longer constrained by mandatory 20-hour classroom or self-study requirements, but you still have to pass the same exam.

7. How should I choose a prelicensing provider now that CDI won’t be approving most courses?

After January 1, 2026, CDI will:

- Continue to approve the 12-Hour Ethics course, and

- Continue to approve bail and public adjuster prelicensing.

For most producer lines, CDI will not be reviewing or approving general prelicensing content.

When you choose a provider, make sure they:

- Align their materials with the California License Examination Objectives.

- Provide practice exams, flashcards, and structured study plans.

- Have a strong track record with California candidates.

SuccessPrelicensing.com is built specifically for this environment: exam-driven content plus the required Ethics course, all under one roof.

8. I work full-time. Can I realistically finish everything and get licensed quickly under the new rules?

Yes, if you are organized. The California prelicensing 2026 framework is actually better suited to working adults:

- You can choose compressed study timelines with intensive exam prep.

- You can time the 12-Hour Ethics course around your job schedule.

- You can use mobile-friendly flashcards and practice exams to keep progressing in small windows of time.

By following a clear plan: prelicensing study, Ethics completion, practice exams, test scheduling, fingerprints, and application; you can move from “thinking about getting licensed” to “licensed and ready to write business” in a much shorter window than under the old 20-hour system.

If you want to take full advantage of the AB 943 prelicensing change and the 20-hour prelicensing repeal, the next step is simple: choose your license line, enroll in the appropriate SuccessPrelicensing.com prelicensing and 12-Hour Ethics options, and build your 2026 license plan around exam readiness, not seat hours.